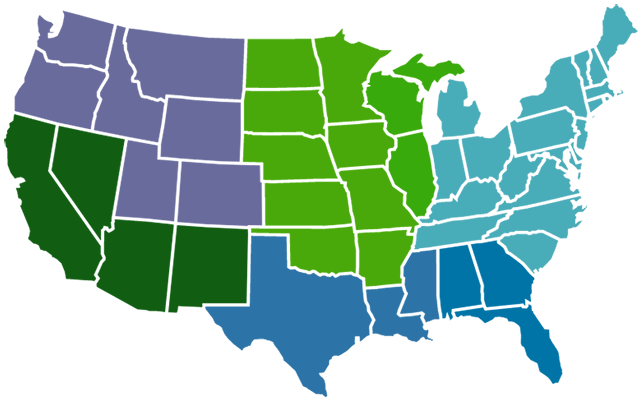

Nationwide Network

About IBG Business

IBG/Fox & Fin is a proud founding member of IBG Business, a nationally respected, award-winning leader in business sales and acquisitions of privately held middle-market companies in every major industry, with more than 1,100 successful closings.

The mission of IBG Business is to bring "best of the best" M&A knowledge and skills to company owners when they are ready to sell a business or make an acquisition. Our firm is of distinctive character and shared values, defined by commitments to deliver business owners excellence in M&A services.

IBG's emphasis is on selling middle-market companies with revenues up to $1 billion (see our completed deals) and assisting business buyers in acquisition searches.

As professional intermediaries, we work with key advisors, buyers and sellers to accomplish successful transfers of business ownership. We bring clients the benefits of intensive research, analysis, innovation, and execution. There is no substitute for IBG's market knowledge, joined with our disciplined M&A process - a system refined by over 1,100 business sales and purchases

among its member firms with over 125 years of experience in business sales among them.