Your Business Value

Know What Your Business Is Worth

Making a good selling decision requires good information. Knowing how much your business is worth, in the mergers and acquisitions (M&A) and business sales context, is far too important to rely on informal advice (even from well-meaning sources), rules of thumb, or dissimilar comparisons.

“[Fox & Fin's] Lance Meilech

valued the business and, on a seven-figure asset sale, came in with a price that was within $3,000 of our independent valuation.”

- Peter P. Fay, on the sale of Mission Hardwood

If you undervalue your business, you leave hard-earned money on the table. If you overprice it, you needlessly delay or even prevent the sale of your business.

IBG/Fox & Fin uses a sophisticated, reliable method for calculating a realistic business valuation. Our business brokers' in-depth process starts with gaining a full knowledge of your business and concludes by comparing it to current market data and, when applicable, comparable business sales.

Our determination of actual market value may be greater than your expectations … or it may be less. Either way, you can be confident that the values we report to you will accurately reflect your company’s market value in a variety of sale scenarios.

Tips for Maximizing Business Value

Business Owners Need to Understand Accounting!

Many business owners aren't familiar with the principles of accounting. They need to understand their profit and loss statements and balance sheets so they can make good management decisions. They also need to understand their financials when dealing with banks, minimizing taxes and negotiating for the sale of their company.

If a business owner doesn't have a background in accounting principles, he or she should consider taking basic courses at a local community or technical college. It can make a real difference in creating profits and maximizing the value of their company!

Minimizing Income Taxes:

Short-Term Strategy or Long-Term Mistake?

Many business owners and their accountants are absolutely fixated on minimizing taxes by showing no income. But this can prove to be misguided planning when you try to get top dollar when selling the company.

Business owners need to realize that valuation is usually determined by a multiple of identifiable cash flow, and that banks make acquisition loans based in part on tax returns.

Minimizing taxes by reducing income or inflating costs can be a short-term strategy that can backfire in the end!

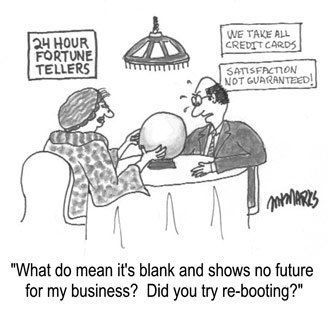

Business Owners Must Take Advantage of New Technologies!

Yes, it's overwhelming. There is so much new technology invading our world it can be hard to understand and realize it's impact. Business owners have to figure out what might help their businesses grow. Whether it be email campaigns, social media, e-commerce, more functional websites, cloud computing or new equipment, business owners need to embrace it. Businesses that do not keep up with the new technologies may find their companies difficult to sell!

Buyers and Sellers Usually Have a Very Different View of the Value of a Business

Most business owners think their business should be priced more than it's worth -- mainly because of all of their hard work over the years. But they have to realize there are certain economics and realities that dictate the price. Besides the various methods of business valuation, the cash flow ultimately must provide the new owner a return on cash investment, ability to service debt and a reasonable salary for the owner and/or manager.

Unfortunately, too many business owners find major disappointment because the marketplace has not accepted their unrealistic asking price.

Time to Revise the Business Plan ... Again!

The days of the five- and 10-year business plan are long over - everything is changing at such a fast pace. Business owners need to review their plan to determine what has already changed and forecast what could change - competition, technology, demand for the product or services of the business, etc. Plans must be updated and must be realistic for the foreseeable future.

The Skeletons Will Have to Come Out!

Whether applying for a loan or selling the company, business owners must be prepared to disclose EVERYTHING.

The business needs to look good – in all areas. To avoid disappointment, business owners must plan, address weaknesses, and be realistic in their expectations if they don't have solutions.

Without a Plan, Business Owners Could End Up with a "Value Gap"!

Most retiring business owners expect that their financial needs will be met when they sell their companies. Unfortunately, that is not always the case. Business owners should have a business valuation performed by an independent professional and then create an "Exit Plan" to close the value gap if one exists.

Who Will Survive?

Many businesses are going through very tough times, with no end in sight. But, as bad a situation as people may be in, it can always be worse - much worse.

Business owners have to be strong and optimistic and provide leadership in these difficult times. They also need to seek good advice and make smart decisions to keep their businesses surviving until things improve. Or, in some cases, they might have to consider selling their company before the situation gets even worse.

Owner Burnout Is Bad for Business!

Many business owners have operated their companies for too long and have lost their interest or drive. As a result, the business can flounder and stop growing.

Not only do revenues and profits suffer, but the value of the company goes downhill. And it only gets worse in a down economy.

When a business owner hits burnout, he or she must learn how to deal with it

or take steps to sell the company.

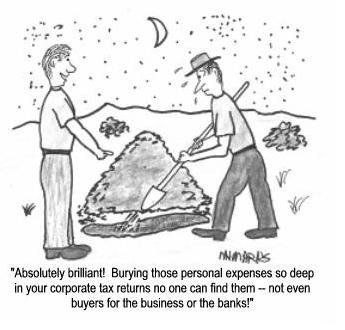

Burying Excessive Personal Expenses in the Business Financials Can Lower Business Value!

The most popular method of valuing a business uses a multiple of earnings over a period of years. Business owners should be aware of that while attempting to reduce the bottom line with personal expenses to minimize taxes.

Though there are a number of deductions that may be added back to determine true cash flow, not all add-backs are considered legitimate by buyers or lenders. Being too aggressive in minimizing taxes today may cost a business owner big dollars at closing.

Some Businesses May Need a Whole New Direction!

Unfortunately, there are businesses whose market has changed so drastically that their products or services now have limited demand. And it might not be the slow economy! Those business owners may have to consider a whole new business model and get into the research and creative thinking mode. A good starting point is searching for ideas on the internet.

See a video on "Re-Inventing Your Business Model" from the Harvard Business Review - it will make you think.

You Can't Always Get What You Want!

The title to the Rolling Stones 1969 hit song seems to echo what the market is telling many business owners these days.

There is no question that prices for many businesses are down, and for various reasons. But if there are offers on the table, a business owner must take a hard look and be realistic as to what has to change in the business or the economy for the price to go up.

Sing along as you listen to the song.

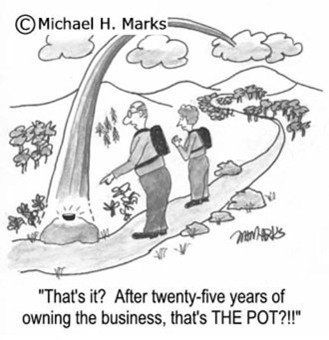

So Where Is that Pot of Gold at the End of the Rainbow?

That pot of gold will be there only for businesses that have been structured to sell – easy-to-read financials, profitable bottom line, key employees in place, growing market, quality products and services – a whole host of issues.

Business owners who are too aggressive on minimizing taxes and, thus, understate their profits might be very disappointed in the value of their business when it comes time to sell.

Understand what buyers are looking for and put plans in place to make your company attractive to a "best fit" buyer.

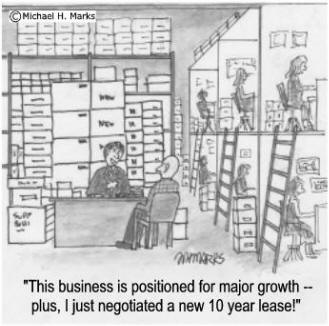

Leases Can Make or Break the Sale of a Business!

The lease terms of the business space can be a major consideration for a buyer. For example, a retail business with a long-term lease at a good location can be attractive. But a long-term lease on a business needing more space to grow could be a detriment. Or there might be concerns for an expiring lease when the landlord might demand a large increase.

When it comes time to negotiating a new lease, business owners must carefully think through the timing of their plans for exiting their business.

Business Owners May Have to Finance the Sale of Their Company

In today's tough economy, obtaining financing for the sale of a business can be challenging. Banks might not like the financials or might not be able to supply the funds, even if they approved of the deal. If a good qualified buyer doesn't have all cash, business owners may have to consider providing some if not all of the financing for the sale of their company.

Of course, there can be risks to seller financing, but there are also potential advantages – such as higher sale price, a greater pool of buyers, and an easier closing process.

Will the Business Numbers Look Good to Anyone Else?

Business owners can operate their company as they wish, but when they are ready to sell, will it appeal to buyers? If the numbers don't make sense or show profits, who would want to buy it?

Business owners who want top dollar for their company must be able to reveal all elements of owner cash flow that buyers and lenders will accept. Otherwise, there will be only disappointing offers or no offers at all!

Don't Let Your Customers Forget You Are Out There!

When sales are slow, business owners have a tendency to cut back on marketing expenses. Unfortunately, not communicating with customers and prospects will only hasten the sales slide and reduce the value of the business.

Today, there are various ways of cost-effective advertising to keep in contact with customers and prospects that might be considered. Talking to marketing consultants, reading books or searching the Internet are ways to find out what is working for others. There are direct-mail campaigns, such as postcards or coupon books. Internet advertising or email campaigns can hit directly at the target audience.

Financial Statements Others Can Understand!

In too many cases, business financials are so confusing that no one can understand them or analyze them. And it’s not uncommon that the tax returns don’t match up with the profit-and-loss statements.

These can become major problems when the business owner tries to obtain financing or sell the company. It is absolutely critical that a business has a set of financial statements and annual tax returns that are easy to understand and make sense to anyone who has to review them.

What About That Big Customer?

Many companies have a single customer or a few large customers that dominate their overall sales. After all, nobody wants to turn down business!

But when it comes time to sell the company, this becomes a huge problem. Most buyers won’t look at a business whose revenues could drop dramatically after closing from the possible loss of a few big customers.

Somehow, someway, business owners have to find a way to diversify their customer base before they ever decide to sell their business.

Timing Is Everything!

Many business owners seem unable to let go of their company and wait too long. Some lose their entrepreneurial drive and the business starts sliding. Or the market starts to change and the company loses value.

To get the maximum price, owners need to do some serious planning to prepare selling the business at its peak.

Special Relationships with Customers

Special relationships that business owners have developed with customers can be a real issue when selling the business. A new owner may have a problem continuing that relationship and this could jeopardize the sale of the business.

It is recommended that business owners begin delegating any special relationships with customers to other company employees as soon as possible.

Keeping Up with Technology

Not all businesses need to have cutting-edge technology, but a company can't fall too far behind. Buyers will be concerned if they must make a large investment in the latest technology to get the company to a competitive level.

A business owner should do the necessary research and purchase the technology to keep the company on par in its industry or be prepared to accept a lesser value for the business.

"My Business Could be a Gold Mine for a New Owner!”

The statement "with a little sales and marketing, a new owner could make a fortune with my business" has been heard over and over by prospective buyers. The question of course is: "Mr. Business Owner, why haven't you made that effort?"

Buyers are not willing to pay the business owner for their future efforts and investment necessary to grow the business. Business owners must take those steps themselves, which not only will increase their revenues and profits in the short term, but will greatly improve the value of their business.

Business Owners Must Make Bold Decisions in Tough Times

Business owners must be proactive to reverse any downward trends, and they must initiate a plan immediately! They cannot be complacent and just hope for the best. They must consider bold or even painful moves such as drastically cutting expenses and staff, adding new product lines or services, hiring a marketing consultant or even acquiring another company.

But sitting back and not taking immediate action is not an option!

Where Are the Business Financials?

If business owners do not have all their financials and tax returns at their fingertips (and many don’t), it usually means they don’t refer to them to effectively manage their operations. It can also mean they don’t understand them.

Business owners should regularly review their financials with their accountant and other advisors to do the proper planning necessary for a successful business. And when it comes time to seek financing or sell the business, these all-important report cards must be immediately available.

Plan for the Future

Many business owners are so busy running their companies that they never seem to have time to plan for exiting the business.

Preparing a business for sale is very different than managing it. It can take years to properly prepare a business for sale to get the highest price. Business owners should start creating an exit strategy at the earliest possible opportunity and consider the assistance of professionals to expedite the process.

Realistic Expectations of Business Value

Unfortunately, most business owners have a very inflated view of the value of their company. And why not? They have put so much money, time and heart into it.

But they need to realize the price is based on what someone else is willing to pay for it. Periodically having a valuation prepared by a professional is a good way to help determine what the business owner needs to do in order to reach his or her goals.

Beware of Understating Your Inventory

Reporting a lower inventory to their accountant is something many business owners have been doing for a long time. And many accountants just accept the number.

In addition to the obvious concerns, when it comes to selling the business, big problems can arise. How will the inventory be valued in the purchase allocations? And who is going to have to pay the various taxes on the larger amount?

Business owners should give their accountants an accurate inventory value each year, to avoid troubles at the closing table!

Don't Do It All!

Some businesses can’t survive without the owners trying to do everything themselves. And there are no key employees in place to help manage the operations.

Buyers for businesses like these may be concerned if they themselves can’t replace the skills and experience of the owner. As a result, these businesses may have very little value to anyone else.

Business owners who don’t delegate need to make a strong effort to have experienced key people in place before they ever try to sell their companies.

Resist Burying Personal Expenses and Assets in Your Company's Financials

Minimizing tax liability is a strategy all business owners think about. But when it comes time to obtain financing or sell the business, buried personal expenses and assets can create a problem in determining the true cash flow.

Buyers and bankers won't always give credit to many of these items. As a result, the cash flow can be suspect. And when you apply a multiplier to determine the value of the business, the results can be disappointing.

It is in the best interest of a business owner to show a healthy bottom line in the years preceding the sale of their business to get the highest price possible.